Vintage Cars Rentals

I have already told you in my previous articles that, Vintage Car is an Asset. This is because it appreciates in its price over the time (Capital Gains) as well as provides you a Passive Income (Cashflow). Now, it is well understood that Vintage Cars appreciate in their price over the time but How can a Vintage car become a steady Income Source? Well, I am talking about Vintage Car Rentals.

There is a Huge Business Opportunity here and that is giving Vintage Car on Rent. You can give your Vintage Car on Rent for following purposes.

- Celebrity Marriages

- Movie producers for shooting of a Movie

- Exhibition of Vintage Cars

- Rent a Vintage Car for Vacation (Yes, in European Countries this is a trend)

Thus, the above are the main 4 income sources of a Vintage Car.

Imperial Classic Limousine Service, Abuquerque, New Mexico.

Monte Bruckman has provided chauffeured trips in '40s and '50s Chrysler Imperials in Albuquerque for 31 years. He’ll customize itineraries along Route 66 and north to Santa Fe, and he drives celebrants to local functions. The star of Bruckman’s fleet is his 1956, long-wheelbase C70 Series Crown Imperial, in its original, un-restored condition. The Crown Imperial limousine was a favorite of presidents and movie stars, but only eight or nine exist today.

Sports Car Rentals, Charlottesville, Virginia

“You feel you’re one with the car,” says John Pollack of Sports Car Rentals, describing his passion for vintage cars. He’s been in business in Charlottesville, Va. since 1995, making his an unusually long-lived American classic car hire venture. Explore Virginia’s country roads in a 1959 MGA convertible, a 1960 TR3, or for another version of nostalgia, his Buick Skylark, a 1963 model with automatic transmission.

Dream Car Rentals, Las Vegas, Nevada

Customers at Dream Car Rentals in Las Vegas will find such fabled American cars as a ‘59 Cadillac Eldorado or a ‘68 Pontiac GTO, the muscle car of choice when the Rat Pack played Vegas. Not surprisingly these automobiles are often in demand for photo shoots and weddings, and they draw the interest of Europeans, impressed by their size and styling.

The Open Road, Stratford, U.K

Based near Stratford, England, Tony Merrygold, started out in 1998 and now rents ten classic cars—nine British and a 1966 Ford Mustang Fastback like the one Steve McQueen drove during the famous car chase in Bullitt. The most powerful, the Jaguars and the Mustang, are also the most popular. “Small and cute doesn’t work,” says the owner, who also maintains a web guide to other rental classics.

Vintage Classics, near Oxford, U.K.

With customers who arrive from all over the world to experience England’s West Country, Vintage Classics is experienced in planning out the best routes and fine local accommodations. As a fan of the British television series “Inspector Morse,” seen in the States on Public Television, the owner, Philip Rowe designed a 156-mile tour that takes in many of the show’s locations. This, of course, is at the wheel of a “Morse Mobile,” the Inspector’s beloved Jaguar MK2 sedan.

Motorparty, Dumfries, Scotland

From Motorparty’s base in Dumfries, Scotland, you can tour the North of England and the Scottish Borders. Martin Edgar has seven cars for rent, the most popular being an E-type Jaguar. The oldest is the 1933 MG Midget making his the only outfit that offers a genuine pre-war MG. To protect this treasure, Edgar requires that you put in an hour’s preparation with his staff before they allow you to drive off. Or they may decide not to.

Aspirations, Brisbane, Australia

In Brisbane, Australia, Richard Gaunt sends a fleet of British sports cars of the '50s and '60s, plus a 1966 Mustang, through the rugged Australian countryside. Among the favorites are the Mustang and a ’69 Jaguar S-Type sedan, but the most sought after is Gaunt’s original purchase, the 1957 MGA that he calls “the happy car.”

Vintage Car Tour, Rome, Italy

Designed by three women who have years of experience in the travel business and are highly knowledgeable about their adopted home, Italy, Vintagecartour.com is aimed at the traveler who has often visited the country and now wants to see it from a new vantage and in the height of luxury. You will travel in small convoys, driving classic Italian cars—such as a Lancia Aurelia or an Alfa Romeo 1750— and stay in the best hotels and villas. They’ll do everything but tuck you in at night. Maybe that too.

Vintage Roads, Touraine, France

From 1934 to 1957 the Citroen Traction Avant, as its name indicates, a pioneering front-wheel drive automobile, played a legendary role in France. Admiring its handling and speed, cops and robbers used it for quick getaways; so did the Gestapo and heroes of the French Resistance. The car takes to the road in such films as The Great Escape, The Sound of Music, and From Russia with Love. Contact Vintage Roads, based in the wine-country of Touraine, to create your own Citroen drama.

Hotel Binders, Innsbruck, Austria

If you’re eager to drive an NSU Ro80, assuming you’ve even heard of it, travel to Innsbruck in the Austrian Tyrol. Here the family-run Hotel BinderS has a fleet of vintage vehicles at the ready, including several of the rare Ro80s. Introduced in 1967, the large German-made sedan, with its radical rotary engine, was promoted as a masterpiece of industrial design but succumbed to a reputation for unreliability. The problems were fixed but the car was doomed, leaving those few survivors to gain new standing today as rare examples. You can rent one only in Austria.

Trabi-Safari, Berlin, Germany and Budapest, Hungary

“How many workers does it take to make a Trabant? Two” an old gag goes. “One to fold and one to paste.” Fashioned of Duroplast (recycled plastic resin strengthened with wool or cotton) and produced in East Germany between 1957 and 1991, this “exhaust-belching matchbox of a car,” as one fan calls it, was virtually the only way East Germans could take to the road. They were obsolete the day the Berlin Wall fell. Yes, it fueled many a joke, but with reunification the Trabi gained a cult following. Now you can hire one to tour Berlin in plastic comfort, or travel to Budapest where renting Trabants is popular (no joke).

Car Collection Investing: Investment in Vintage Car Collection

Car Collection Investing: Investment in Vintage Car Collection

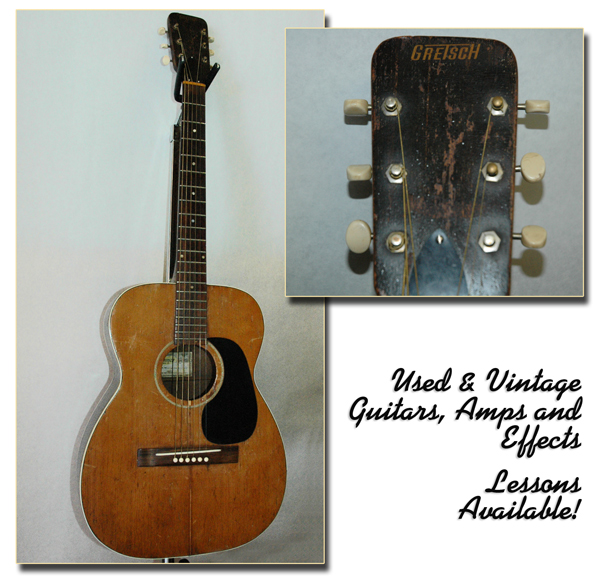

Mac Yasuda Collection of Vintage Guitars

Mac Yasuda Collection of Vintage Guitars