Investing in Vintage Guitars

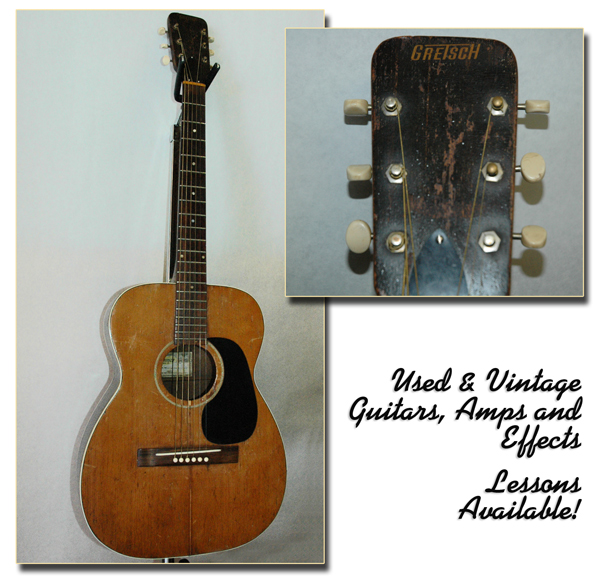

Do you know that Vintage Guitars are Assets? And people invest in it? Owning a Vintage Guitar is exactly same like owning any other asset such as stocks, bonds, gold, real estate or businesses. Vintage Guitars are the hobby as well as Investment vehicles.

Some vintage guitars now command astronomical prices as non-playing investors jam the market. But while prices for the rarest models are still rising, new buyers who head into this arena may get burned.

Have you ever think that, Just How much a Guitar can be worth?

Well, a Guitar can be worth of more than the worth of your home or a portfolio of stocks.

A Vintage Guitar can start from anywhere around $ 10,000 and may end up into $ 50,000 or even more. Yes, Owning a Vintage Guitar is this much costly.

Vintage Les Paul Guitar 1961

Vintage Guitars can give you anywhere between 20%-50% per annum compounded annual return.

Now Read the following Hypothetical Story and you will realize that, How Vintage Guitars are Worth?

"A couple of the guys at the table started arguing over which would be a better investment: putting a Les Paul in a vault for 10 years, or putting the $10,000 in a T-bill account," recalls Steve Soest, one of the dealers present. "That knocked a bit of the magic out of the day."

Those arguing against the guitar's longevity would have done well to heed a song in the Stones' set that day: "Time Is On My Side." Within 10 years, sunburst Les Pauls were selling for $50,000 . . . then $60,000, and then $80,000. Now they are so coveted that plainer ones go for upwards of $150,000, while those with a pedigree or particularly dramatic flamed-maple tops have pushed past $300,000. The nine-pound guitars are worth their weight in gold, five times over.”

Now, What is the meaning of the above story? It means that Vintage Guitars have given 10 Times more return than the US Stock Markets in the last few decades. This is Crazy. No other Asset class in world appreciates this much.

Why Vintage Guitars appreciate this Much?

The reason why Vintage Guitars appreciate this much is because There were only about 1,700 sunburst Les Pauls originally made.

It means that, the Supply is constant but the Demand is constantly rising among the investors and hobbyists. This Demand-Supply mismatch drives the prices of this valuable asset to the sky high.

Guitars are now become a rare commodity. They are so much valuable that, Investors are crazy about investing in this Asset Class.

Not only this but a Guitar Case is also important. A Vintage Guitar case can cost you $ 10,000 or even more.

Mac Yasuda -

Mac Yasuda is one of the world's foremost foremost vintage-guitar collectors. He is a California based guitar dealer and a friend of the actor Steve Segal. He started off running an English language school in Kobe Japan in the 70s and eventually became one of the largest vintage guitar dealers/collectors in the US.

Mac Yasuda Collection of Vintage Guitars

Mac Yasuda Collection of Vintage Guitars

Here is a story of Yasuda.

“Yasuda started singing and playing country music when he was a teenager in Kobe, Japan. When his hero Hank Snow performed there in 1967, Yasuda and his band-mates got to meet the singer backstage. "A Japanese company had just started making steel-string guitars, and we brought ours to show off. Hank was playing a beat up 1934 Martin D-28, so I asked him, 'Hey, Hank, you're such a rich and famous guy. Why won't you buy a brand new guitar like this?' He just kept laughing over that, and his band did too," he recalls.”

The above video is of 1007, Arlington Vintage Guitar Show.

The above video is of the Best Vintage Guitar in Paris. See how great the collection is?

Thus, this is everything about Investing in Vintage Guitars, I hope that this much information is useful to you.

0 comments:

Post a Comment