Never Borrow to Invest in IPOs

Recently Coal India has listed on the stock exchange with 20-25% premium price. Not only this but during this Diwali, several banks are giving women loan to buy a gold coins/gold jewelleries for 9 months EMI.

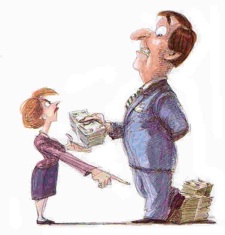

In fact, many people are borrowing money at 21% for just 10-12 days of loan against their savings accounts balance and mutual funds portfolio to invest in IPO.

But wait….!!!!

Don’t you think that there is something wrong here?

I mean ideally you should invest with your surplus money right? Well, Yes. The basics of investing is that, you invest your surplus money and not with the borrowed money.

Unfortunately, financial awareness in India is very low and that’s why right now many people are borrowing money from banks to invest in IPOs as well as in gold.

Well, remember that the first principle of successful investing is that, you should be get out of debt first. You can not invest with borrowed money.

Of course, the Hedge funds invest with borrowed money (Leverage). But well, they are hedge funds and their investors afford to loose money. But not you.

After a great success of Coal India, many people are preparing to borrow money for the future IPOs like Lodha Developers, Reliance Infratel, Neptune…etc..

But well, this is the wrong investing. Someday you will suffer a great loss. So better to avoid investing with borrowed money. You should only invest with the surplus money and not with the borrowed money.

Believe me, investing in Gold & IPOs with borrowed money is not the true investing. So better to avoid such things.

0 comments:

Post a Comment