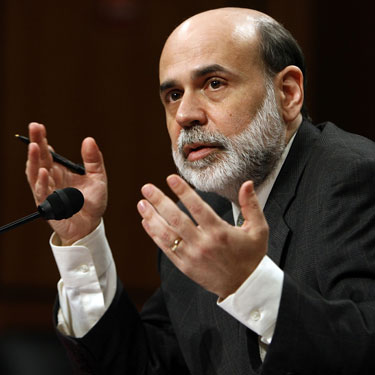

Bernanke Liquidity Trap: What’s It?

Advisoryanalysts.com says,

"There is the possibility... that after the rate of interest has fallen to a certain level, liquidity preference is virtually absolute in the sense that almost everyone prefers cash to holding a debt at so low a rate of interest. In this event, the monetary authority would have lost effective control."

John Maynard Keynes, The General Theory

One of the many controversies regarding Keynesian economic theory centers around the idea of a "liquidity trap." Apart from suggesting the potential risk, Keynes himself did not focus much of his analysis on the idea, so much of what passes for debate is based on the ideas of economists other than Keynes, particularly Keynes' contemporary John Hicks. In the Hicksian interpretation of the liquidity trap, monetary policy transmits its effect on the real economy by way of interest rates. In that view, the loss of monetary control occurs because at some point, a further reduction of interest rates fails to stimulate additional demand for capital investment.

Many of you may not understand exactly what is it? But well, this is actually the side effect of printing excessive money (Known as Quantitative Easing in sophisticated language).

Usually during the time of the recession, the government increases its money supply by increasing bank reserves and reduce the interest rates so that investors and entrepreneurs borrow this money at low interest rates and invest in the economy to develop businesses and create new jobs thus reducing the unemployment rates.

But well, after certain level, the reduction in interest rates fail to stimulate the additional demand for this newly printed money and this is known as the liquidity trap.

The main aim behind reducing the interest rates is to motivate investors and entrepreneurs to borrow more money to create businesses and jobs in the economy.

0 comments:

Post a Comment