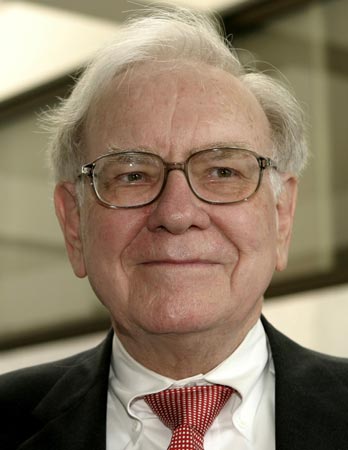

Warren Buffet started Investing at the age of 13 Years

Bill Gates started Microsoft at the age of 20 years

Mark Zuckerberg started Facebook at the age of 14

Rich: At What Age They Start Investing?

There is an old saying in the Investment world and that is, “The Best Start to start investing was 20 years before and the second best time is Now. So Start Investing as early as possible in your Life.”

This is because the early you start, the more wealth you will accumulate and the more rich you will become. The Compound Interest is so powerful over the time that it multiplies your wealth in a breath taking manner. But for that you have to start early.

All the Rich people of the world today are rich because they have started Investing several years back in their very young life. Probably in their early twenties or even before that. Warren Buffet started Investing at the age of 13 and today he feels that he was late.

Bill Gates has started Microsoft Corporation at the age of 20 years and today he is world’s richest person (2009) at the age of 55.

Mark Zuckerberg has started Facebook when he was just 14 years old and in the 2008, at the age of 23 years he became world’s youngest self-made billionaire ever.

All of the above examples suggest that, the earlier you start, the more wealth you will able to accumulate. The main mistake most of the people do in their life is that, they give undue high importance to the education. They spend years and decades in colleges for taking higher professional skills. This is because they think that after taking a higher educational degree, they will earn more.

But they don’t know that by not start investing early ultimately they are compromising with the huge amount of wealth.While Rich people are smart. They know that, Education System is no longer effective to ensure any kind of Financial success. So they start early. Sometimes they drop out from the college also to start their own business and Investments.

Say for Example, Bill Gates, Larry Page (Google), Larry Ellison (Oracle), Dhirubhai Ambani (Reliance) are the few examples of drop out billionaires. And there are several multi-millionaires in the world who drop out from their colleges to start developing their businesses and investments early.

Remember, Time is the most precious asset. Lost money can be recovered but the lost time can never be recovered…!!!

0 comments:

Post a Comment